Last Updated: Dec 14, 2025

Editor note: This article was updated on December 4th, 2025. Added an example for a Bitcoin whale. Rehaul the entire how many bitcoins to be a whale? – Zoran Spirkovsk, Editor-in-Chief.

A Bitcoin whale is a term used to describe an investor or entity that holds a large quantity of Bitcoin. Bitcoin whales are influential in the market due to the large volume of cryptocurrency they control. This article explains what a Bitcoin whale is, how many Bitcoins it takes to be considered a whale, and who holds the most Bitcoins. It also examines the impact of these large holders on the global cryptocurrency market.

For more information on the concept of Bitcoin whales, visit Investopedia’s Bitcoin Whale Explanation.

Bitcoin Whale Definition and Market Impact

A Bitcoin whale is an investor or entity that holds a substantial amount of Bitcoin. These large holders can significantly influence Bitcoin’s market price, and their trades can cause price fluctuations due to the volume they represent.

Bitcoin whales can affect market sentiment. When whales move large amounts of Bitcoin, they may trigger short-term price changes. Their behavior is closely watched by traders and regulators alike. Large transfers between wallets or movements to exchanges often signal potential selling or buying pressure. These events can create ripple effects across the market. Whales can manipulate prices by orchestrating large transactions, either intentionally or inadvertently.

Because Bitcoin transactions are public on the blockchain, observers can track the activity of known whales. This transparency has led to extensive research on the role of whales in market dynamics. Whales’ movement of funds is often a sign of market shifts. Analysts use data from blockchain explorers and market research firms to assess the impact of whale movements on Bitcoin’s price and volatility.

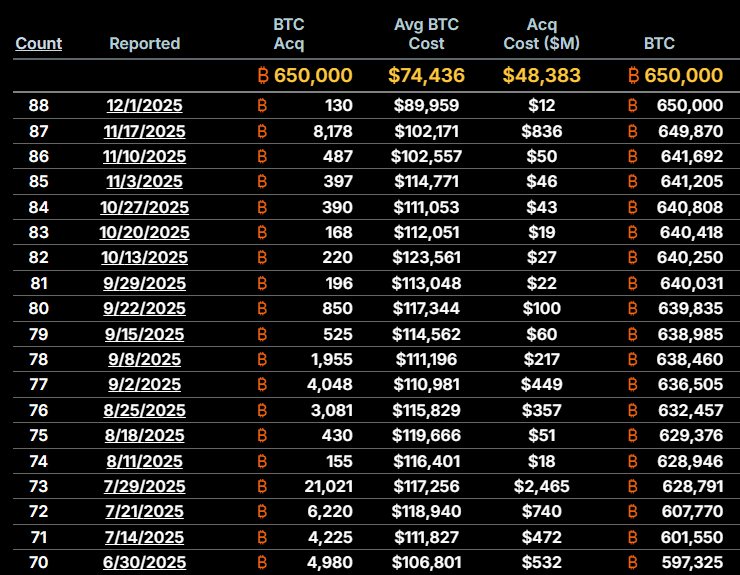

A very common example in recent times is the purchase of Bitcoin by institutions. So-called Bitcoin treasury companies purchase Bitcoin regularly. One of the most important ones in recent time is MicroStrategy (now Strategy) led by Michael Saylor. The company has more than 80 recorded purchases of Bitcoin and has acquired more than 650,000 Bitcoin.

How Many Bitcoins to Be a Whale?

The overall consensus within the wider bitcoin community is that a whale is a market-moving entity. This can mean many things, and it’s very difficult to put a USD price on it. So we have to consider it in terms of supply. We have 21 million Bitcoin in total. Satoshi has 1.1 million. By definition, he is the ultimate whale. To get data, we can look at Arkham Intelligence’s bitcoin page.

Next come the exchanges. Here, the math is a bit dicey because exchanges keep funds for other people. How much does an exchange really own? It is rather unclear. But as an entity that has crypto, most exchanges (at least the ones you know about) are indeed whales.

Then we have the funds, custodians, and governments. There’s a handful of them who absolutely dominate. We have BlackRock, Fidelity, the US government, and the El Salvadorian government. We have Michael Saylor with MicroStrategy (now Strategy). Greyscale Robin Hood and Tether. These all have more than 80,000 Bitcoin at the time of writing.

From here, it’s really debatable how what constitutes an impact on the market because whalehood is defined by impact. If any of the above entities decide to sell their Bitcoin, it would have an immediate, noticeable effect on the market. Conversely, a whale could be somebody with USD looking to buy Bitcoin. We would be interested in how much USD you have and how big of a dent that’s going to make in the market.

The simple answer is: anybody with more than 1,000 can be considered a whale, but that is changing everyday. It’s becoming more and more increasingly difficult to be a whale. As of December 2025, fewer than 100 entities hold more than 1,000 BTC according to Arkham Intelligence.

And if you have thoughts about it, there is a Reddit conversation that’s been going on for six years about what it means to be a whale.

Who Holds the Most Bitcoins?

The identity of the largest Bitcoin holders is a subject of ongoing analysis in the cryptocurrency industry. Early Bitcoin miners and institutional investors control some of the largest known addresses. Public figures, companies, and even exchanges hold substantial quantities of Bitcoin. For example, institutional custodians, such as those managing exchange-traded funds (ETFs), may hold significant amounts.

Early adopters, sometimes called “Bitcoin whales,” accumulated large stakes when Bitcoin was relatively inexpensive. Several known funds and institutional holders also keep extensive Bitcoin reserves. Although pseudonymous addresses often obscure precise identities, researchers have identified clusters of large wallets belonging to entities such as Bitwise Asset Management and Grayscale Investments.

Additionally, some large-scale exchanges hold Bitcoin on behalf of their customers. These holdings are sometimes mistakenly attributed to individual whales but are pooled assets. Analysts use data from blockchain explorers to determine that a few addresses control a disproportionate share of the Bitcoin market. This data is key to understanding “who holds the most Bitcoins” and the potential influence of these holders on market trends.

For example, a well-known early Bitcoin wallet, often associated with the founder of Bitcoin, is frequently cited as one of the largest Bitcoin holders. Institutional investment firms, too, are reported to have significant Bitcoin exposure.

The debate about who holds the most Bitcoin continues as new investments and movements occur daily. Renowned data sources such as Chainalysis and Coin Metrics offer extensive reports that shed light on the concentration of Bitcoin holdings among whales and large institutions.

Market Influence and Future of Bitcoin Whales

Bitcoin whales exert a considerable influence on market movements. Their transactions can lead to significant price swings. When whales buy or sell large quantities, the market often reacts sharply. The aggregated activities of these large holders affect overall liquidity and volatility. Analysts continue to track whale behavior using blockchain analytics platforms. They observe that large-scale trading strategies can shift market sentiment quickly.

Looking ahead, the role of Bitcoin whales is set to evolve. As the crypto market matures, whales will likely benefit from more robust regulatory frameworks and transparent market practices.

Institutions are increasingly participating, further consolidating whale influence. This evolution may lead to more predictable market behavior, even as large holders continue to impact short-term price movements. Some analysts predict that greater institutional participation will reduce the relative influence of individual whale transactions.

Despite varying opinions, one fact remains clear: Bitcoin whales are a fundamental component of the digital asset ecosystem. Their activities drive liquidity, influence market trends, and shape investor sentiment worldwide.

Concluding Observations on Bitcoin Whales and Market Dynamics

In summary, a Bitcoin whale is an investor holding a significant amount of Bitcoin, often above 1,000 BTC. These large holders, whether individual early adopters or institutional investors, significantly influence market trends and liquidity.

The ongoing debate about what qualifies as a whale, combined with evolving market practices, makes it a crucial subject for industry observers. As transparency increases and regulatory measures evolve, understanding who holds the most Bitcoin and their market behaviors will be vital for predicting future price movements and market shifts.

Change Log

- Dec 13, 2025 – Added internal link a newly published “What is Bitcoin Dominance?” article.

- Dec 5, 2025 – This article was updated on December 4th, 2025. Added an example of a Bitcoin whale. Rehauled the entire how many bitcoins to be a whale? section.

- April 17, 2025 – Originally published

Editor note: This article was updated on December 4th, 2025. Added an example for a Bitcoin whale. Rehaul the entire how many bitcoins to be a whale? – Zoran Spirkovsk, Editor-in-Chief.